Strategic Assessment

The purpose of this paper is to shed light on the strength and significance of global maritime trade in general, and Israeli maritime trade in particular. Furthermore, it seeks to analyze the various disruptions that have affected maritime trade in recent years, including exceptional events such as climate phenomena, the COVID-19 pandemic, and the Swords of Iron war, whose ramifications are only beginning to emerge. In particular, this paper discusses the current disruptions in supply chains due to the Iranian and Houthi attacks on shipping routes in the Red Sea. These disruptions indicate numerous weak points in the stability and operation of global supply chains, which are crucial for the national economies and security of numerous countries, particularly Israel.

Over the past three years, the world has experienced a series of extreme events that have significantly affected various aspects of life, especially the global economy. This paper examines these events and their repercussions on global geo-logistics—the distribution of supply chains according to level and type. Additionally, it includes a description and analysis of Israeli foreign trade, specifically highlighting the import processes and the types of cargo that have been affected by the disruptions during the period in question. Israel’s grain imports, which are vital for the country both in normal circumstances as well as during emergencies, are used as a case study. Furthermore, the paper also surveys the operational conditions, including challenges faced in the ports of origin of the various cargoes and recent challenges within this market.

Keywords: supply chains, maritime trade, choke points, climate crisis, COVID-19, Swords of Iron, Houthis, Israel

Introduction: Global and National Maritime Trade, Scope and Potential for Disruption

About 85% of global trade (by weight) is currently transported by sea, some 14% by land, and less than 1% by air. The weight of the sea freight is about 12 billion tons, in which 4.7 billion tons consist of energy in various forms, including coal for steel manufacture; 4.4 billion tons are mainly iron ores, other bulk cargoes, and chemicals; about 2 billion tons are goods in containers, and about 0.9 billion tons are general cargoes (Clarksons, 2023).

Israel’s foreign trade in 2022 (in terms of weight and volume) totaled about 84 million tons, of which 83.5 tons consisted of goods transported by sea (99.6% of Israel’s total foreign trade, in a variety specified below).[1] Regarding maritime trade, Israel is entirely dependent on the import of raw materials, most consumer goods, and, to a large extent, its energy cargoes (such as coal, crude and refined oil, and refined petroleum gas). The discovery and production of natural gas in Israel and the beginning of its use to generate electricity and for industry have significantly reduced dependence on energy imports. Most of the supply chains on which Israel relies for its imports are long from a geographical perspective and based on maritime transportation, as a result of Israel’s complicated relations with its neighbors and the almost insurmountable problems of operating with them via land bridges, except for relatively small quantities of cargoes in transit, largely through the Jordan River terminal.[2] Therefore, it is important to understand that Israel’s existence as an “island state”—(particularly in economic terms) due to its geopolitical situation and geographical location—depends on foreign trade, largely by sea.

The Israeli economy is known for its high percentage of international trade in relation to its GDP (over 50%). In terms of weight and volume, the majority of this trade is seaborne. Approximately 99.6% of Israel’s foreign trade, by weight and 65% by value is transported via maritime routes. Therefore, the openness and security of Israel’s ports and shipping routes—Sea Lines of Communication (SLOC)—are of vital importance for its trade, both in routine times and during emergencies.

Given the importance of supply chains for the global economy in general, and Israel’s economy (and national resilience) in particular, this paper seeks to analyze the primary factors for their disruptions during the years 2020–2023, which represent a unique period in the history of modern logistics. We argue that these disruptions were akin to “black swan events,” which are entirely unpredictable but must be considered as essential parts of risk assessment and prudent planning. This is especially crucial in light of increasingly frequent climate events, which pose a constant threat and have a direct impact on Israel’s ability to prepare for emergencies, given its complete reliance on stable and dependable supply chains. The paper concludes by highlighting the valuable insights gained from these disruptions to the Israeli economy.

In addition to climate problems—which many consider to be the greatest threat to the planet, as participants expressed at the 2022 World Economic Forum in Davos (World Economic Forum, 2022)—and other significant natural events such as pandemics (the COVID-19 pandemic, whose impact is discussed later), Israel’s maritime trade is, of course, also exposed to political and security threats and disruptions. A maritime blockade or the use of military force by a sovereign country or a terrorist organization to disrupt supply chains to and from Israel’s ports would have a direct impact on the country’s ability to function. That is due to its geographical and economic position as an “island state.” A recent example illustrating the use and significance of a maritime blockade can be seen in the conduct and outcome of the maritime blockade imposed by Russia on Ukraine at the start of the war between them in February 2022 (Wedemeier & Wolf, 2022).

Another form of economic warfare that involves restrictions on maritime trade is the imposition of sanctions on a particular country, limiting its imports and exports and thereby affecting manufacturers and companies engaged in logistics (by sea, air, and land)—whether owned by governments or by private citizens. The sanctions currently imposed on Russia, Iran, and North Korea serve as an example (Al-Attar, 2023).

Disruptions to international trade and supply chains can also occur as a result of events such as maritime accidents. For instance, two years ago, the Suez Canal was blocked for several days following a maritime accident. A detailed report attributed the accident to human error combined with anomalous weather conditions (Chambers, 2023).

It follows that deliberate actions by states or organizations, economic processes, natural phenomena such as abnormal climate conditions, maritime accidents, or a combination of these factors could cause serious damage to Israel’s supply chains. In any case, prolonged disruption would have disastrous consequences for the Israeli economy, as well as for the country’s national resilience and security. This is due to the potential damage to logistic systems in general, which would have a fatal impact on the levels of inventory levels needed to operate civil and security systems and the replenishment of those inventories.

Maintaining sufficient inventory levels could seemingly save the need to identify import solutions in emergencies and enables a certain solution within a limited time frame for disruptions in the supply chains. However, it can be understood that the maintenance of inventories, however large they may be, is not a full substitute for the continued existence of foreign trade during an emergency, especially over time. The risks involved in maintaining high levels of inventories, include preservation measures considering the shelf life and durability of the goods over time, large and expensive storage facilities for the extent of the required quantities, and the strategic risk and appeal of damaging such stock concentrations during war.

Furthermore, in addition to the challenges of defining and building emergency inventories, it is important to note that there are approximately ten million people in Israel. The storage of emergency inventories of multiple goods for such a population, especially for extended periods, has not yet been discussed and fully decided at the national level. This is due to the wide range of goods and products that are considered essential today, beyond the basic goods that currently define emergency stocks. Additionally, the import of consumer goods, despite the applicable supervision and regulations, is predominantly controlled by numerous private importers. This becomes problematic when it comes to national essential inputs. While a country’s considerations are primarily strategic rather than economic, the private sector generally assesses its activity in economic terms. Therefore, organizing the subject of inventories for emergencies in Israel’s consumer markets is not fully feasible without state intervention, which would have significant economic consequences.

The expansion, lengthening, and complexity of supply chains in the global trade is not a new phenomenon. Outsourcing in the western world has expanded into all sectors, including services, in line with the rising standards of living or as a result thereof. Commercial organizations have embraced the slogans of the lean enterprise, minimal inventories, logistic manipulations in storage systems and distribution methods and other changes that all serve one purpose—stretching and streamlining supply chains to their maximum capacity (Kajjumba et al., 2020). The guiding principle is that the most successful one—the survivor and the winner—is the one who knows how to reduces costs and optimize supply chains by making them the most flexible, fast, and cheap. Outsourcing and the relocation of manufacturing from the West to Eastern and Southern Asian countries (as well as other developing regions) have proliferated, significantly broadening the range of goods whose manufacturing (and even the required knowledge) has shifted away from the West to other areas, particularly Asia.

This trend has intensified in recent years, based on:

- Global standardization of a growing range of products, as a result of regulations or choices made by manufacturers;

- Advancements in communication technologies and their improved reliability, facilitating quick and efficient data and knowledge transfer;

- Numerous international and bilateral trade agreements, including those established within political or regional blocs. These agreements actually defined the product specifications and manufacturing methods;

- The most striking element in terms of reliability, accuracy, and capacity is the upgrade and enhancement of maritime transportation capabilities.

Maritime trade routes have been improved in various ways, such as by the widening and enhancement of the Panama Canal and the Suez Canal, as well as by the increase in the dimensions of the ships in accordance with the growth of trades. These upgrades have been made possible by shipping companies and ship owners who lease their vessels. Their efforts have significantly developed and improved the capacity and performance of ships, with a focus on efficiency and profitability.

The COVID-19 Pandemic—An Upheaval but also the Source of Many Lessons

The COVID-19 pandemic that fully erupted in early 2020, when it seemed that supply chains had been stretched to their limits, led to an extreme situation. Coping with COVID-19 beginning with significant lockdowns at various levels and left its immediate marks on disruptions to the point of severing many supply chains (Ivanov & Dolgui, 2020).

China implemented an aggressive strategy to prevent and eliminate the spread of COVID-19, known as Zero Covid. It imposed strict lockdown measures, primarily in China’s main trading and port cities. However, to this day, the Chinese labor market and manufacturing sector have not fully returned to their pre-January 2020 performance levels (Wu et al., 2023). This policy affected all Chinese logistics industries and services. Gradually, a shortage of means of transportation began to appear due to manpower pressures as a result of the long and strict lockdowns. The lack of manpower and restrictions on movement slowed down the operations in China’s main ports, leading to long queues of ships waiting to be processed. This caused “traffic jams” in the movement of goods, slowing down even to the point of stopping the emptying of import containers and the transfer of the empty containers for filling and export, as well as other disruptions to the continued flow of trade that characterized Chinese exports.

The COVID-19 pandemic in the West resulted in heavy pressures on demand and an unprecedented lack of empty containers for Asian cargoes. Additionally, it created a shortage of cargo space on ships, thus decreasing the available capacity for transportation—due to ships waiting for operations in ports and reducing by such the weekly capacity on various trade routes (Berger, 2022). As a result, the demand for maritime transportation and capacity increased worldwide, for which the shipping industry was not prepared, causing an unprecedented surge in maritime freight rates.

The pandemic expansion to the West also led to reactions that further intensified the abnormal pressures on the global supply chains, with some chains even being halted. There was a significant increase in demand for medical products, particularly protective products, disinfectants, sanitizers, medical automation, and medicines originating in Asia, which had been outsourced in the past.

Furthermore, the lockdown measures in the West brought about noteworthy changes in consumer product markets. While demand for services fell due to the strict lockdowns, there was a dramatic rise in the demand for consumer products, especially those used at home, as people spent more time at home. The shift to remote work also resulted in increased purchases of home office products. Most of these purchases were made online—particularly during lockdowns—placing unprecedented pressures on supply chains. This created a particular emphasis on the “last mile,” the last link in the chain before delivery to the end user, which is generally the weakest link in the chain (Macioszek, 2018).

Demand for products also increased due to the economic actions taken by many western governments, aiming to maintain the public’s standard of living and to prevent economic collapse through cash grants. This resulted in abnormal demand for goods from Asia (including China, where manufacturing and export activity gradually resumed), coupled with the spread of lockdowns in the West and a severe shortage of skilled labor resulting in significant disruption to logistic processes in the West.

“Traffic Jams” in Maritime Trade and Damage to Supply Chains

The damage to logistics processes included a phenomenon of congestion at seaports due to ships waiting in the ports’ piers and their entrances. This congestion occurred in a market that had become accustomed to rapid and efficient port operations, which had been adjusted to adequate inventory levels for the swiftness and efficiency of pre-pandemic logistics according to the “just in time” concept.

These dynamics created delays that broke every known record, particularly in the ports of the west coast of the United States (Anguiano, 2021). Later, the slowdown increased to the point of not releasing import containers that remained full for very long periods (many businesses stopped their activities at one time or another during the lockdowns and, as a result, abandoned or rejected the containerized cargo that came for them from Asia)

This slowdown created considerable shortages of various products and fueled a vicious circle of stockpiling for fear of shortages. This shortage was caused by those serious disruptions to the supply chains, disruptions that only increased the fear, the desire, and the need to stockpile essential inventories, both from private parties as well as from organizations and governments.

Disruptions to manufacturing processes were another factor leading to shortages, as well as the economic burden of maintaining larger reserves and additional storage facilities. These events, combined with a shortage of empty containers, caused maritime transportation costs to skyrocket by up to 1,000% compared to pre-pandemic prices. Consequently, inflationary pressures intensified in western countries, adding to the economic slowdown already underway prior to the pandemic, with nominal (but also real) increases in the prices of goods, products, and consequently, services.

Moreover, the pandemic further strained relations between China and the West, particularly the United States. This has a significant impact on supply chains, especially in the realm of advanced technology hardware and software products, as well as other goods and raw materials.

Political and Security Events as Disruptive Factors

Political tensions between China and other countries led to changes in transportation routes and patterns for raw materials, such as iron ores, other ores, grains, and other products. Additionally, shifts in custom duties policy between China and the West diminished the economic value of producing and exporting these materials to the West. For example, China had imposed an embargo on coal, which had been imported from Australia (Cave, 2020), leading to changes in the import routes of Indonesian coal. The embargo was only lifted at the beginning of 2024, as Chinese–Australian relations improved (He, 2023).

In this context it is important to note that any significant changes in transportation or geographical routes have direct implications for the shipping market and can trigger a chain reaction in other markets worldwide. For example, China’s switching of coal imports from Australia to Indonesia, which completely altered the ton/mile ratio based on the proximity of the origin to the destination and also the ship size in this service, resulted in a surplus of one type of ship and a shortage of another, with consequences for other global bulk markets.

Another significant event that immediately affected the global supply chains was the outbreak of the Russia–Ukraine war in early 2022 just as the world was beginning to recover from COVID-19. For centuries, Black Sea ports and their agricultural hinterland had served as a crucial source of grains for the people along the Mediterranean coast. The Russian blockade on the Ukrainian ports disrupted and occasionally broke the supply chains from these ports, stretching between the Danube and Dnieper rivers, as well as between the ports of the Azov Sea and the Black Sea itself. This blockade posed a major problem for many countries that relied on Black Sea grains, as they were forced to seek substitutes from more distant and expensive sources.

Additionally, a significant portion of the exports was halted due to sanctions imposed on Russian government companies or companies associated with the authorities, which not only affected production but also maritime transportation (International Trade Administration, 2022). The exports of various petrochemical and chemical products from the Black Sea, including essential items such as urea for transportation and fertilizers for agriculture (primarily sourced from Russia and Ukraine) were disrupted and even halted due to American sanctions. Despite certain easements of sanctions relating to Russian export of food products and fertilizers for agriculture (Office of Foreign Assets Control, 2022), global markets were severely disrupted, causing real shortages and unprecedented price increases for these products, especially fertilizers, whose vital importance for feeding the world’s population is clear beyond any doubt. Moreover, even countries in Eastern Europe without a direct border on the Black Sea, such as Hungary, which exports loads of grain through the Romanian port of Constanta or other ports along the Danube River, temporarily stopped exporting grains, due to concerns for their own national reserves, further intensifying the sense of shortages among grain importers worldwide (Komives, 2022; Hungary Today, 2022).

The disruption of port activity on the Black Sea also caused a shortage of products from the iron and steel industries in that region. While this contributed to some increase in the production and export of mainly Chinese steel, it also caused fears among steel buyers, especially those who relied on Black Sea manufactured products. As a result, they began increasing their orders and reserves from alternative sources, to safeguard against future shortages.

The export of goods from Russian and Ukrainian ports on the Black Sea stopped almost completely. What was not disrupted due to damage to the production sources was disrupted by the Russian blockade on the ports of Ukraine—which used the blockade and mainly agriculture exports as a means of pressuring the West—and interrupted the supply chain (Kumar, 2023). In addition, the American economic boycott on Russian products, logistic services, and organizations (U.S. Department of the Treasury, 2022) severely damaged the Russian economy (U.S. Department of the Treasury, 2023).

The damage to manufacturing and exports is extremely problematic for Ukraine, as it heavily relies on the export of essential goods, such as agricultural produce, to countries outside the Black Sea region, particularly in the Middle East and North Africa. These countries depend on grain imports, which have become more expensive due to the disruption in supply chains. For example, Egypt’s Prime Minister Mostafa Madbouly claimed that despite government subsidies, the cost of making Egyptian pita bread had increased from 65 piastres before the war in Ukraine to 90 piastres in 2023, causing public unrest that threatened the stability of the Egyptian government (Barel, 2023). In an attempt to support Ukrainian grain exports and ensure food security in developing countries, the UN sponsored the Black Sea Grain Initiative (BSGI), which included representatives of Turkey, Ukraine, Russia, and the UN (United Nations, n.d.). Although this initiative operated for about a year until mid-2023, it came to an end when Russia withdrew its participation. However, the corridor continues to provide active defense for the Ukrainian navy and transports various cargoes beyond the original agreements in the BSGI (Ukraine Business News, 2024).

The analysis of the cases described above highlights the numerous challenges associated with maintaining the supply chain. These problems were obscured within the logistic processes from the beginning and throughout their evolution, resulting in their current complex nature. The significance and potential impact of the restrictions and defects that caused disruptions could only be comprehended once they actually occurred, by examining how they manifested and developed.

Disruptions due to Climate Conditions

A significant factor contributing to disruptions in supply chain operations is climate change, including global warming and other natural disasters. Global warming naturally leads to other extreme natural events, such as flooding, landslides, forest fires, volcanic eruptions, heatwaves, and hurricanes. While it is not yet possible to directly link geological events to climate change, the impact of earthquakes and their damage, including tsunamis, large volcanic eruptions and their consequences for air travel and the global atmosphere cannot be ignored.

Other climate-related phenomena affecting global and regional supply chains and maritime traffic are the complete or partial blockage of vital shipping routes. For example, Europe has experienced lower rainfall levels and drier air, leading to a significant decrease in the water levels of its main rivers, such as the Po and the Rhine. These rivers, particularly the Rhine, have served as the main transportation arteries of Europe since ancient times, forming a network that spans the entire continent with connecting canals. The decline in river levels severely restricts or even halts the passage of commercial ships (Handley, 2023). Although this effect is largely seasonal and can be rectified by a few days of heavy rain, as occurred on the Rhine in August 2023 (Hogan, 2023), it still causes serious disruption to supply chains within Europe. Replacing these waterway routes with regular overland transport (trains, trucks) is extremely challenging due to the large volumes of goods that need to be transported.

One of the most challenging issues is the implementation of restrictions on crossing the Panama Canal. While this occurs annually during the dry season, in 2023 the restrictions were more severe due to an extended dry season. As a result, the number of ships allowed to cross the canal each day was reduced to slow down the transit speed and conserve water that is pumped into the ocean by the canal mechanism. Additionally, the depth of the water has decreased, limiting the hull depth of the ships that pass through (Panama Canal Authority, 2023). To clarify the operational aspect of the problem, it should be noted that modern container ships, such as the NeoPanamax,[3] must reduce their cargo by approximately 30,000 tons (equivalent to about 3,000 TEU)[4] to comply with the new restrictions when crossing the Panama Canal. Apart from the economic damage, which represents a 15–20% reduction in the ship’s potential capacity, the supply chain is significantly disrupted as more ships are needed to transport the same volume of cargo, assuming they are even available. These disruptions to the Panama Canal are expected to increase in the coming years due to anticipated climate changes caused by El Niño (World Meteorological Organization, 2023).[5]

Threats and Attacks on Trade in the Red Sea

On November 19, 2023, after a series of declarations and warnings, Houthi militants seized control of the vehicle carrier Galaxy Leader, believed to be owned by an Israeli businessman operating from the Isle of Man. The hijacked ship was then taken to the Yemeni port of Hodeida, under Houthi control, and has since remained anchored there, with no signs of its release. In addition, there have been numerous attempts to attack commercial ships in the Gulf of Aden in the southern Red Sea, near the Bab el-Mandeb Strait, using drones carrying explosives or ground-to-sea missiles launched from northwest Yemen. While some ships sustained damage, no casualties were reported.

These events have raised concerns among shipping companies, particularly those operating container ships, due to the threats posed by the Houthis and their Iranian patrons. Initially, fears were directed toward shipping lines linked to Israel or vessels with full or partial Israeli ownership. As a result, the Zim company decided to reroute its shipping line from Asia to Israel and Turkey for a route around Africa, circumventing the Red Sea and its threats. Other shipping lines followed suit, including those importing vehicles to Israel (primarily for unloading in Eilat), as well as Israeli-owned ships leased to foreign shipping companies with routes unrelated to Israel.

On December 3, three vessels were attacked in the southern Red Sea. While one of the vessels was owned by an Israeli citizen and carried a cargo of grain from the United States to China, the other two had no connection to Israel in terms of their operators or cargo. These attacks demonstrated that all ships passing through the Bab el-Mandeb Strait were at risk, regardless of their association with Israel or Israeli citizens. Consequently, more ships chose to follow Zim’s route and sail around Africa to avoid the Red Sea and the Suez Canal when traveling to the Mediterranean, Europe, and even the East Coast of the United States. This trend has continued as the Houthis have intensified their attacks on ships.

To understand the economic implications of these events, it is necessary to consider the added financial burden for shipping companies that choose the longer route to the eastern Mediterranean, which includes ports in Israel, Turkey, the Black Sea, Greece, and the Adriatic. The route around Africa is approximately 8,000 nautical miles longer. Traveling at a typical average slow speed of 16 knots to conserve fuel costs and reduce carbon emissions, results in an extra 21 days in each direction, especially when sailing westward at a faster pace. For a ship with a capacity of 5,000 TEU (which is the most expensive to operate on this route and much larger than the average ship), this leads to an additional charter hire of around $650,000, container costs of $250,000, and fuel costs of approximately a million dollars. After deducting the Suez Canal crossing fee of about $250,000, the additional costs total approximately $1.65 million dollars in each direction. This corresponds to an extra $350 per TEU or $700 per 40-foot container in each direction. In practical terms, this increase in cost translates to an extra $0.66 per every textile item in the container, and over $2 for each electrical device or item with a volume of 0.1 m3 (such as a television screen).

This additional cost erodes the remainder of the contribution of the freight fees to the shipping companies—a contribution that at the level of demand for sea transport and the freight rates that prevailed on the eve of the Red Sea events hardly covered (if at all) the fixed costs of the average ship. This fact was reflected often in the losses of the shipping companies in almost every shipping service in the world (RTTNews.com, 2024). This erosion in freight rates can be attributed to various factors, including a surplus supply of new ships, a slowdown in the transportation market, and a decreasing demand for maritime transportation. Consequently, commercial ships that sailed between Asia and the Mediterranean operated at an average load factor of 80%–85%, due to the combination of reduced demand and surplus supply. Although the shipping companies tried to raise rates, these attempts were largely unsuccessful due to the aforementioned reasons and the market behavior. Consequently, shipping companies have been unable to recoup their costs, leading to mounting losses. Obviously, if the shipping companies could match their rates to the changes and their additional fixed costs, no shipping company would have incurred losses.

This freight rate behaving model explains why shipping companies were unable to raise their rates above market levels, resulting in only a modest price increase. In this context it is important to note that the cost of war insurance for ships visiting ports in Israel can range from $50 to $100 per container, adding an additional 20 cents to the cost of importing a television screen, or 0.01 cents to the price of an imported shirt. It is also worth mentioning that during the years 2021–2022, amid the COVID-19 pandemic, the cost of shipping a container from Asia to Israel in the spot market rose to $20,000. By 2023, this price gradually dropped to around $1,600 for a 40-foot container. However, these rates reductions were not reflected in lower prices for imported goods, and the cost of living showed no significant changes. Therefore, aside from exchange rate fluctuations and shifts in demand, it can be concluded that transportation fees have minimal impact on the prices paid by the consumers.

This situation and the challenge of dealing with Houthi terror are highly volatile. The scale and intensity of the attacks are rapidly escalating, extending beyond Israel. It is currently impossible to predict how the major shipping companies will react. Naturally, they will not agree to accept long-term losses due to a local conflict between Israel and Hamas. The market is already preparing for price increases, at least to cover the additional costs. It is hoped that this matter, which needs to be treated as an international incident, will be resolved as quickly as possible to prevent shipping companies with a significant share of the Israeli market from refusing to provide service (as has already occurred with some companies holding a smaller market share).

Aside from the current increases in transportation costs across all shipping lines worldwide (after experiencing a significant decline last year), it is important to acknowledge that the additional sailing days pose challenges for importers in the West. These challenges primarily revolve around inventory management, which is carefully planned on a strict weekly timetable and specific delivery days following the ship’s arrival at the port. Irregularities in schedules make it difficult to determine inventory levels, resulting in extra costs and in some cases, compromising the shelf life of the final product. Consequently, this also affects the interest to be paid on credit during the import process, adding to the overall burden, particularly for larger importers.

The extended sailing time of four to six weeks, as calculated above, makes it extremely challenging to maintain regular (weekly) schedules. Prior to the Houthi attacks, there were approximately 50 idle ships suitable for trade between Asia and the west. Assuming that each shipping line requires an additional four to six ships to sustain the level of weekly port visits, this situation disrupts schedules and increases the gaps between visits. While this may decrease the number of annual sailings for each line, the reduced supply of sailings improves the performance of ships that currently face low demand-to-volume ratios. These ships currently operate at 75%–85% capacity on sailings from Asia.

The Main Causes of Supply Chain Disruptions

There are several causes of disruption in supply chains, but we will focus on the five main ones:

- The production sources of certain goods present challenges in terms of availability

In addition to political problems and tensions between countries, production or trade slowdowns or stoppages, there is also a shortage of skilled workers to sustain production. While the initial shortage could be attributed to the impact of the COVID-19 pandemic, particularly in the Chinese market, the current shortages are primarily caused by geopolitical events such as the Russia–Ukraine war and its consequences. These events have disrupted or halted numerous sources of production and the distribution of goods.

Regarding the ability to manufacture, especially in the food industry, the issue of climate should be seriously addressed. The ongoing effects of climate change, including global warming, flooding, desertification, and seasonal, temporary, and cyclical demand fluctuations, significantly affect the ability to produce food. Climate phenomena like El Niño and La Niña, which primarily affect the southern and central parts of the Pacific Ocean have a substantial impact on global weather patterns, consequently affecting crops and sources of nutrition worldwide.

- Overreliance on maritime transport and secondary logistics (such as land transport and logistic centers)

The processes of outsourcing, globalization, and the quest for cost-effective production and export sources have led to an unprecedented dependence on maritime transport and its associated logistic services. In addition to the significant increase in transport costs as a result of the pandemic, there are various barriers, such as the availability of vessels, international restrictions (such as the Arab boycott, trade restrictions between Turkey and Cyprus), and other factors that limit the efficiency of maritime transport. The centralized nature of the industry is also worth mentioning as approximately ten corporations dominate about 85% of the international container ship market (Alpha liner, 2023).

- Technological changes in the maritime transport industry (particularly the significant increase in ship size)

Competition in the maritime transport industry and the need for shipping companies to reduce their fixed costs have led to a kind of competition among shipping companies. Within two decades container ships have tripled in size, with the largest ones carrying over 24,000 TEU. These massive vessels have a length exceeding 400 meters, a width over 60 meters, and a hull depth of at least 16 meters.

There are two main problems associated with this increase in size. One is the need to continuously adapt port infrastructures to accommodate the larger dimensions and meet the demands for rapid ship processing. This requires significant investment with uncertain returns over many years. In addition, there are complex environmental conflicts related to expanding and upgrading ports. Each country faces its own constraints and must maintain its direct link with global markets, regardless of other countries’ actions.

The other problem is the vulnerability of these infrastructures and ships to accidents, which directly correlates with their operational and economic consequences. For example, in early 2021, the ship Ever Given became stuck in the Suez Canal, blocking cargo ships for about a week. The incident had a dramatic global impact, leading to the diversion of ships around Africa and changes in ship operations. The estimated economic damage was in the billions of dollars and legal proceedings are still ongoing (Yee & Glanz, 2021). Other disasters include the fire on the Maersk Honan in early 2018, which resulted in losses and damage to hundreds of containers, and the One Apus, which lost hundreds of containers in an extreme storm at the end of 2020 (van Marle, 2020). In both cases, the economic damage is estimated in the hundreds of millions of dollars or more.

- The significance of climate change for supply chains, particularly maritime

The impact of climate change on maritime transport is still relatively lower compared to the other areas discussed above. However, the increasing importance of this sector should not be disregarded. Current evidence shows that the effects of climate change on maritime transport are mainly seen in falling water levels, particularly on inland waterways, such as lakes, rivers, and canals. For example, droughts and low rainfall in Europe have caused water levels to drop, hindering ship passages. Additionally, the decreasing water level of Gatun Lake in the center of the Panama Canal (Skinner, 2023) has started to noticeably affect traffic flow through the canal. This is immensely important since this traffic plays a crucial role in global supply chains. Furthermore, the shipping industry, including the International Maritime Organization (IMO), has already issued warnings about severe weather conditions and their implications for the reliability and resilience of supply chains at a conference on the consequences of climate change for global shipping (World Meteorological Organization & International Maritime Organization, 2019).

- Spaces and regions of strategic importance

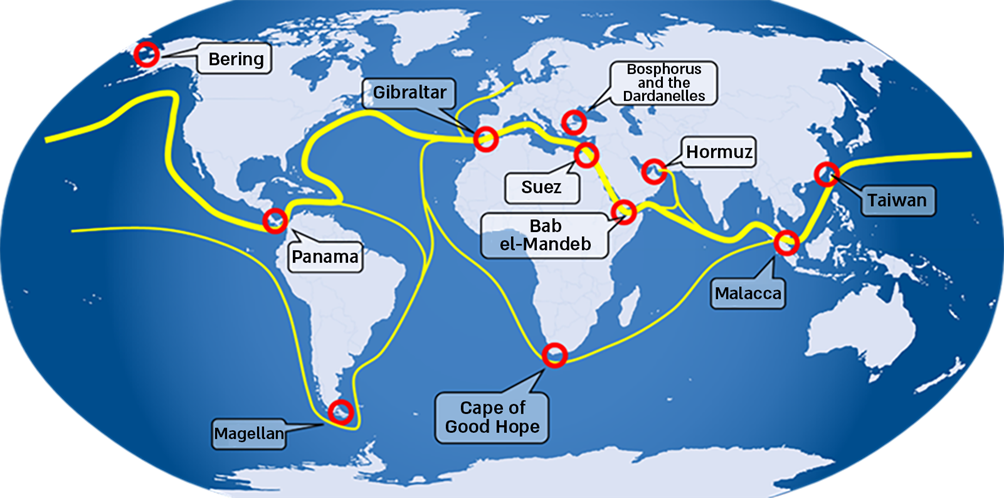

When examining strategic points of failure in maritime supply chains, it is essential to consider maritime straits as one of the most significant factors. A strait is a narrow sea passage that connects two seas, oceans, or other bodies of water, typically located between two land masses. Important straits, also known as choke points, have immense geographical, commercial, and political importance due to the convergence of interests (see Figure 1). They are not only geographically narrow but also strategically vulnerable to blockades caused by natural or man-made military events. The significance of these choke points has increased with the rise in the volume of maritime traffic in recent years, accompanied by larger ship sizes and longer shipping routes, as a result of globalization and expanded commercial ties.

In any analysis of maritime supply chains, it is crucial to identify and study these choke points, as they are often located near territorial conflicts, acts of maritime terrorism, piracy, smuggling (including weapons), and other hostile activities that pose risks to civilian shipping. Due to their restricted dimensions (depth and width), traffic load, and other factors influence the traffic volume, these choke points present challenges for ships (see Table 1). Sea Lines of Communication (SLOC) and trade in these choke points can be easily disrupted or blocked. The growth in traffic, combined with larger ship sizes that lead to operational difficulties and risks, increases the likelihood of blockages caused by various factors, creating a significant impact. Areas surrounding choke points can sometimes face threats or restricted access; however, longer routes that bypass these points are often impractical, due to additional costs and longer transit times, significantly disrupting the supply chains.

Figure 1: Global Sea Transportation Routes and Their Choke Points | Source: Open Source, routes and labels added by Yigal Maor

Sea Routes and Choke Points

The most important choke points for maritime transportation (not in order of importance) are as follows:

- The Strait of Malacca along the southwest coast of Asia and the Indian Ocean.

- The Strait of Hormuz between the Arabian Gulf and the Indian Ocean.

- The Suez Canal, which links the Mediterranean and the Red Sea.

- The Bab el-Mandeb Strait, which connects the Indian Ocean and the Gulf of Aden to the Red Sea and the Suez Canal.

- The Panama Canal, which joins the Atlantic Ocean and the Pacific Ocean.

- The Bosphorus and the Dardanelles Straits, linking the Mediterranean through the Sea of Marmara to the Black Sea.

- The Strait of Magellan, connecting the southern part of the Pacific Ocean and the Atlantic Ocean.

- The Strait of Gibraltar, linking the Mediterranean and the Atlantic Ocean.

- The Bering Strait, in the northern Pacific, linking Alaska and Russia, with the Arctic Ocean (affecting future shipping routes in the Arctic Circle) (TEC Container, 2021).

- Taiwan

- Cape of Good Hope

| Name of passage (strait) | Annual no. of ships | Potential to increase volume | Passage restrictions | Potential disruptions |

| Hormuz | 50,000 | Limited | Navigational difficulties | Political instability in the Arabian Gulf |

| Bab el-Mandeb | 22,000 | No known problem | Navigational difficulties and security | Piracy and terror |

| Suez Canal | 18,000 | Limited by planning | Ship size | Political instability in Egypt, terror |

| Bosphorus & The Dardanelles | 40,000 each | Limited (in size and number) | Ship size | Sailing safety, local restrictions |

| Gibraltar | 300,000 | No known problem | No known problems | None known |

| Taiwan | 180,000 | No known problem | Policy | Tensions with China (PRC) |

| Malacca | 60,000 | Limited (in size and number) | Ship size | Piracy |

| Cape of Good Hope | No known problem | No known problem | Weather | |

| Panama | 14,000 | Limited (in size and number) | Traffic size and volume | Low water level, maritime accidents |

| Magellan | Limited (in size) | Weather | Weather | |

| Bering | No known problem | Weather | Weather |

Table 1: List of the World’s Main Choke Points

National Aspects of Supply Chains and Disruptions in their Activity

To discuss the impact of supply chains and disruptions on Israel, it is important to consider the strategic significance of the Mediterranean Sea, the Red Sea, and the Arabian Sea. These bodies of water play a crucial role in terms of geostrategic, economic, and military importance, as they connect various seas and basins through strategic choke points. The Mediterranean Sea, in particular, serves as the primary sea route for east-to-west and north-to-south trade, transporting raw materials, fuel products (including liquefied natural gas and liquefied petroleum gas), crude oil and refined products, and various types of coal between the producing and consuming countries. It is also the only route through which Black Sea countries, particularly Russia, can engage in international maritime trade year-round. The Mediterranean Sea is a busy shipping route, accounting for approximately one-third of international maritime trade (about 220,000 ships per year), including 20% of global energy traffic and 25% of container trade. However, it is also a politically unstable region, with terrorist groups operating to achieve regional and global ambitions. This region also faces a serious problem of refugees fleeing from the eastern Mediterranean and Africa toward Europe. In addition to the Mediterranean region, the Arabian Sea, which is part of the Indian Ocean, is an important trade route, mainly for energy cargoes.

More than half of the world’s armed conflicts currently occur in the Indian Ocean region. As early as 2012, nearly 120 warships from 20 national fleets were present in this area, to safeguard their countries’ national interests. While the first decade of the 21st century witnessed an increase in maritime piracy in the Arabian Sea region, in recent years, there has been a surge in violence, the sophistication of weapons, and the willingness to attack shipping routes by both countries and terrorist organizations around the Arabian Sea. Iran and its proxies, the Houthis, have seized control of ships, laid mines along shipping routes, and launched attacks on vessels using small boats and drones (Horev, 2021).

Understanding the main disruptions in the supply chains can help assess the risks and unique challenges that Israel faces in its foreign trade. The use of maritime transport through Israel’s ports is critical for its foreign trade due to its significance and scale. According to data from the Central Bureau of Statistics (CBS) and the Israel Ports Authority, maritime trade through Israel’s ports accounted for 99.6% of the country’s total foreign trade in terms of weight and volume by the end of 2021. During that period, Israel’s total foreign trade, including energy (coal and fuels), reached approximately 81.5 million tons. In 2022, maritime trade increased to 83.5 million tons, with energy products accounting for 23 million tons, and the remaining 60.5 million tons distributed as shown in Table 2.

| Total trade | Imports | Exports | ||||||||

| Type of cargo | Total in millions of tons | % of total trade | Total imports in millions of tons | Import share of cargo type in % | % of total imports | % of total trade | Total exports in millions of tons | Export share of cargo type in % | % of total exports | % of total trade |

| General | 6 | 7% | 5.5 | 92% | 9% | 5% | 0.5 | 8% | 3% | 1% |

| Dry & wet bulk | 21.5 | 26% | 12 | 56% | 20% | 8% | 9.5 | 44% | 51% | 11% |

| Bulk seeds & products | 5.5 | 7% | 5.5 | 100% | 9% | 7% | 0 | 0% | 0% | 0% |

| Containers | 27.5 | 33% | 19 | 69% | 31% | 23% | 8.5 | 31% | 46% | 10% |

| Total, excluding energy | 60.5 | 72% | 42 | 69% | 42% | 18.5 | 82% | 22% | ||

| Energy (coal & fuels) | 23 | 28% | 19 | 83% | 31% | 35% | 4 | 17% | 18% | 5% |

| Total | 83.5 | 61 | 73% | 22.5 | 27% | |||||

Table 2: Cargoes in Israeli Ports in 2022 (Quantities and Shares in Percentages) | Source: Israel Ports Authority, 2022

Table 2 shows that imports constitute 92% of all general cargo activity, which includes metals, forest products (wood and paper), bulk products in sacks, project cargoes (large machinery, dismantled factories) and vehicles. For wet and dry bulk cargoes, import and export quantities are nearly equal, at 56% and 44%, respectively. However, the nature of the cargo differs significantly. Imports include bulk chemicals and cement, while exports primarily consist of Dead Sea and Negev products (potash, phosphates). Grains and fodder products are imported, including grains for human consumption, fodder and seed (such as canola and sunflower products), glutens (protein from seeds for animal fodder), corn seeds, and soybeans.

Container activity is different because it is reported by weight, with import by weight accounting for 69% of all container activity, and exports for 31%. However, the correct analysis (although it does not significantly change the split between imports and exports) should be based on TEU. Analysis in these units represents the actual ratio between imports and exports, revealing that imports account for 76% of the total container activity, compared to only 24% for exports (see Table 3).

| Type of activity | Imports (unloading) in TEU | Imports as share of this activity in % | Exports (loading) in TEU | Exports as share of this activity in % | Total | Share of total activity in % |

| Full containers | 1,388,000 | 76% | 437,000 | 24% | 1,825,000 | 58% |

| Empty containers | 24,000 | 3% | 933,000 | 97% | 957,000 | 31% |

| Total, excluding transshipment[6] | 1,412,000 | 51% | 1,370,000 | 49% | 2,782,000 | 89% |

| Transshipment | 175,000 | 50% | 175,000 | 50% | 350,000 | 11% |

| Total activity | 1,587,000 | 51% | 1,545,000 | 49% | 3,132,000 |

Table 3: Analysis of Container Activity in Israeli Ports in 2021 (in TEU) | Source: Data from the Israel Ports Authority

The data in Table 2 and Table 3 indicate several important points regarding Israel’s foreign trade activity. First, container activity is the dominant type of traffic in Israel’s ports (excluding energy-related activity), representing 33% of the total weight of goods transported. This category includes consumer goods and a significant portion of raw materials. Importantly, the import component is prominent, accounting for 76% of full container activity. This is evident from the number of empty containers that are returned for balancing,[7] particularly in the direction of Asia.

Second, general cargo activity primarily involves the transportation of raw materials and goods, such as metals, forest products and vehicles, which cannot easily be transported in containers due to their volume and weight. It should be noted that general cargo container activity leans heavily toward imports, similar to energy cargoes. This can be attributed to Israel’s complete reliance on importing most general goods and energy, as there is no local production capacity. The increased use of liquefied natural gas in industry and electricity generation, as well as the expansion of electric vehicles for private and public transportation is expected to significantly affect Israel’s energy import figures.

Third, while the figures in Table 2 indicate an equal division in bulk cargo activity between imports and exports, it is important to emphasize that these two activities are vastly different. Imports consist of minerals and chemicals that are crucial for the Israeli economy and industry, while exports primarily include fertilizers and chemicals from the Dead Sea Works and the Negev.

These points, in conjunction with the imports–exports ratio presented in Table 2 and Table 3 underscore the fundamental nature of the activities in Israel’s ports, both in normal times and during emergencies. They also highlight the critical importance of avoiding any disruptions, including container activity, which serves as the primary means of transporting consumer goods in the Israeli market.

The significant container activity in Israel, which is twice the global average at approximately 15%, and its importance to the Israeli economy were among the reasons for the development and upgrade of the container ports in Ashdod and Haifa, as well as the establishment of the new South Port and the Haifa Bay Port. The four corporations, including two port companies, involved in this activity will address the country’s critical container activity for at least two or three decades, aiming to prevent any logistic bottlenecks caused by insufficient port infrastructure. At the same time, the import of grain to Israel presents a problem, as the current infrastructures in Haifa and Ashdod are reaching their minimum capacity for unloading these cargoes. In response, construction has recently begun on additional infrastructure at the Haifa port shipyard, with future plans to expand the grain unloading facilities.

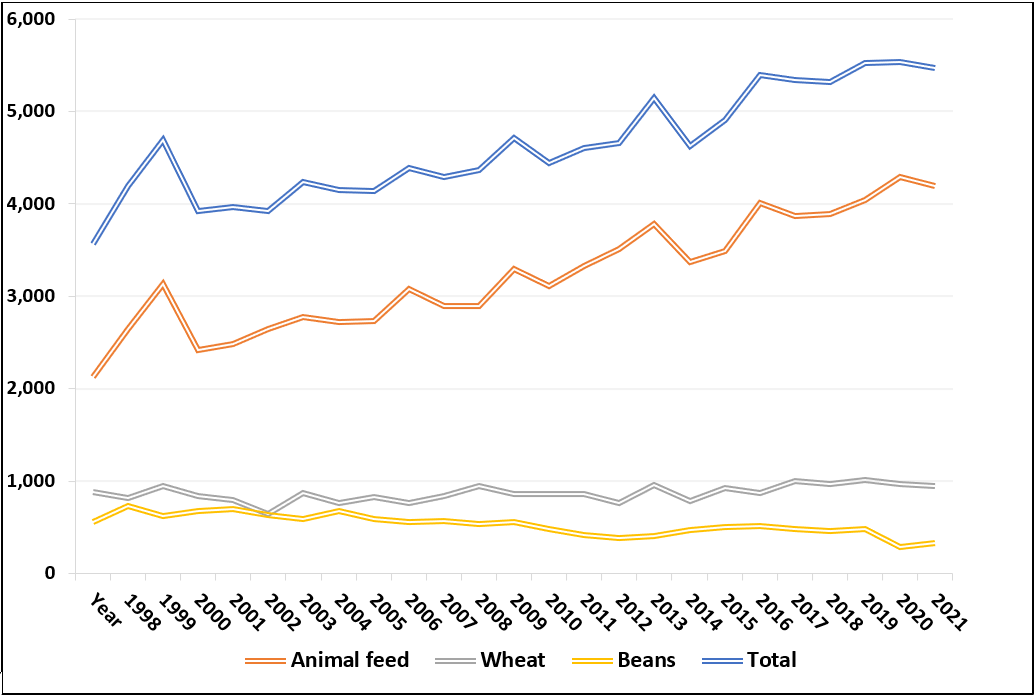

It is important to note that the available agricultural land in Israel, used for various crops, can only meet a small portion of the country’s needs. Therefore, there is significant reliance on the import of grains and fodder to Israel, totaling about 5.5 million tons in 2022. Over 20% of these imports are seed products, which serves as protein sources for animals. This highlights the crucial need for the current level of imports. Additionally, more than 75% of the grain and fodder imports are intended for animal feed, underscoring the importance of suitable infrastructure for this type of activity, which directly affects the consumption of meat and other animal products in Israel.

The import of grains, as discussed below, presents a challenging case, due to the complexity of its infrastructure and the difficulties in obtaining cargoes as a result of external factors beyond the control of the importers or the state. Israel mainly relies on the grain silos in Haifa (Millennium Silos, formerly Dagon Silos) for imports of grains and seed products. However, these silos, which have been in operation for 70 years, are expected to be phased out according to city plans to develop Haifa’s sea front, and alternative storage options are being constructed as part of this plan (City Plan A/13/3).

The silos in Ashdod partially support the operations of the Haifa silos and have become more efficient since the construction of a seed conveyor belt from the dockside to the storage silos in 2022. However, the capacity of the Ashdod silos and their storage space are insufficient to fully replace the Haifa silos should they break down or cease operations. Additional silos and unloading infrastructure are currently being constructed in the Israel Shipyards port, with further plans for construction on the eastern dock of the Haifa Port Company grounds.

Currently, the two unloading facilities in Haifa and Ashdod can handle up to six million tons (nominal) of seed cargoes annually, depending on the volume, storage duration, and proper operation of the unloading infrastructure. It is possible to increase this volume by upgrading the unloading facilities and adjusting the silo storage capacity or conditions. However, emergency measures to expand the capacity of the existing silos will not be necessary in the next few years due to the ongoing construction of new infrastructure.

Figure 2 indicates that the imports of grains, seed products, and beans (mainly soybeans) into Israel are approaching the processing and storage capacity of the existing infrastructure. It is important to note that due to the physical structure of the facilities, all seed products are unloaded using grabs instead of automatic unloading equipment of the silos. These products are also not stored in the silos and should therefore be excluded from the total quantity of seed cargoes unloaded and stored in the silos.

Figure 2: Import of Grains & Cereal Products to Israel, showing Trends by Type of Cargo, 1998–2022 (thousands of tons) | Source: Website of Zenziper Ltd.

It is important to understand that a significant fault in one of these infrastructures, such as the Millennium Silos in Haifa and Ashdod Silos, can seriously disrupt the grain supply chain in Israel, potentially even making imports impossible. When calculating the grain imports, it is crucial to consider the estimate of risks and the time required to overcome obstacles. It is also important to segment import sources of imports and analyze the consequences of changes in the supply chain length and the time to reach Israel. It can be assumed that any substitute source would be further away than current sources. For example, bringing wheat from Argentina instead of Ukraine would add about three weeks to transportation time.

It is also essential to remember that most import cargoes to Israel are in private hands, supervised and regulated by the private sector. This poses a problem concerning essential inputs for the country; as the private sector prioritizes economic terms rather than national feasibility. Therefore, careful calculations should be made regarding the optimal reserve level, considering risks and the potential use of alternative sources, even if they are not cost-effective for routine activity. All logistic factors should be assessed in their complexity, especially in a global transportation market where the state lacks control over the availability of means, such as ships, to ensure the country’s supply chain.

Conclusion

The unprecedented challenges faced by global supply chains are primarily driven by political events, such as those in the Red Sea, together with climate events, such as the current “drying up” of the Panama Canal. These events have created a unique and destabilizing situation that serves as a painful reminder of the price paid for globalization. While globalization has undoubtedly improved the average standard of living worldwide, it has also made supply chains extremely sensitive to factors that can disrupt them.

Over the last three years, various factors have converged that highlight the vulnerability of globalization, including the COVID-19 pandemic, political events in Eastern Europe and the Middle East, and intensifying climate changes due to global warming. While these warning signs may not necessarily signal a fundamental shift in globalization since the 1980s, they do emphasize the need for countries to prioritize the resilience of their supply chains, especially for essential goods and products.

One potential solution to address the vulnerability of extensive global supply chains is to shorten them. Countries could consider sourcing supplies and goods closer to their own shores, exploring substitutes for certain products, and even reintroducing domestic production of consumer goods. After relying heavily on overseas resources for many years, a move toward shorter supply chains could help mitigate risks.

In this context, Israel’s position is particularly sensitive. Over the past few decades, the country has increasingly outsourced the production of a wide range of goods, resulting in an economy heavily reliant on cheap and easily obtainable products from around the world. Unfortunately, this has come at the expense of Israeli agriculture, which was once renowned and respected. Instead of nurturing domestic agricultural practices, Israel has prioritized quick imports from neighboring countries and more distant sources. Both political and natural events have unequivocally demonstrated the dangers of this dependency.

Ensuring the country’s economic and nutritional security hinges on bolstering Israel’s industry and agriculture as much as possible, reducing its reliance on outside factors. While complete self-sufficiency is unattainable for a country of Israel’s size and resources, there is undoubtedly a need to maintain adequate reserve stocks, encourage domestic industries through reshoring and support and cultivate the agricultural sector. Implementing these measures would make a significant difference to Israel’s economic and nutritional security.

The document was written with the support of Konrad Adenauer Stiftung Israel and is part of the work of the "Chain Reaction" research team that deals with disruptions in supply chains and their impact on national security and regional stability. Project partners: Archimedes Center at Tel Aviv University, Yesodot Institute and Gazit Institute.

References

Al-Attar, A. T. (2023). Current US sanctions with respect to the Russian Federation: Successes, challenges and a new model for economic statecraft. Business Law International, 24(1), 51–92.

Alphaliner. (2023, August). Alphaliner Monthly Monitor, 12.

Anguiano, D. (2021, December 22). ‘Like a freeway in traffic’: America’s busiest ports choked by a pandemic holiday. The Guardian. http://tinyurl.com/mr489s8n

Barel, Z. (2023, January 20). Egypt is on the edge, and Netanyahu could push it over. Haaretz. https://tinyurl.com/y29zn76j

Berger, P. (2022, October 21). Southern California’s notorious container ship backup ends. The Wall Street Journal. http://tinyurl.com/5n6vhr59

Cave, D. (2020, December 16). China battles the world’s biggest coal exporter, and coal is losing. The New York Times. http://tinyurl.com/mrxt39px

Chambers, S. (2023). 68-page final investigation report into the Ever Given Suez grounding released. Splash 247.com. http://tinyurl.com/t7bk84eb

Clarksons. (2023, August). Seaborne Trade Monitor.

Handley, L. (2023, August 4). Drought threatens major European river trade route with ripples across the continent. CNBC. http://tinyurl.com/3f3vnjjm

He, L. (2023, May 5). Australia’s exports to China hit record high as relations thaw. CNN. http://tinyurl.com/47dtedbn

Hogan, M. (2023, August 2). Rhine River levels in Germany back to normal after rain. Reuters. http://tinyurl.com/ytuxtas4

Hungary Today. (2022, March 7). Grain export from Hungary banned. http://tinyurl.com/5n8yxxmt

International Trade Administration. (2022, July 21). Russia—country commercial guide—Sanctions framework. http://tinyurl.com/4xpsxm9s

Ivanov, D., & Dolgui, A. (2020). Viability of intertwined supply networks: Extending the supply chain resilience angles toward survivability. International Journal of Production Research, 58(10), 2904–2915. https://doi.org/10.1080/00207543.2020.1750727

Kajjumba, G. W., Nagitta, O. P., Osra, F. A., & Mkansi, M. (2020). Offshoring-outsourcing and onshoring tradeoffs: The impact of Coronavirus on global supply chain. In M. Franco (Ed.), Outsourcing and Offshoring. IntechOpen. http://tinyurl.com/26ahsbpm

Komuves, A. (2022, July 4). Hungary to ban all grain exports effective immediately—agriculture minister. Reuters. http://tinyurl.com/47anbyba

Kumar, M. (2023, August 26). EU’s Dombrovskis asks Russia to renew Black Sea grain deal. Reuters. http://tinyurl.com/53sj8u9u

Macioszek, E. (2018). First and last mile delivery—Problems and issues. In G. Sierpiński (Ed.), Advanced solutions of transport systems for growing mobility. Advances in intelligent systems and computing, 14th scientific and technical conference “Transport Systems. Theory & Practice 2017” (Vol. 631, pp. 147–154). Springer Cham. https://doi.org/10.1007/978-3-319-62316-0

Office of Foreign Assets Control (OFAC). (2022). OFAC food security fact sheet: Russia sanctions and agricultural trade. http://tinyurl.com/2w2ft8uw

Panama Canal Authority. (2023, July 25). Advisory to shipping No. A-35-2023. http://tinyurl.com/msd86xvz

RTTNews.com (2024, February 8). A.P. Moller-Maersk hit by Q4 loss, buyback termination, FY24 warning. Nasdaq. http://tinyurl.com/57vzhtsb

Skinner, A. (2023, June 15). Chart shows dramatic drop in Gatun Lake levels as drought hits Panama Canal. Newsweek. http://tinyurl.com/a7exftf3

TEC Container. (2021, August 2). Straits, channels and other hotspots for maritime transport. http://tinyurl.com/42xmax7b

Ukraine Business News (UBN). (2024, February 9). The Ukrainian maritime corridor has exported more goods than the UN-brokered grain agreement. http://tinyurl.com/rs44f9c7

United Nations. (n.d.). Joint Coordination Centre for the Black Sea Grain Initiative. http://tinyurl.com/2pxz7whk

U.S. Department of The Treasury. (2022, February 28). Treasury prohibits transactions with Central Bank of Russia and imposes sanctions on key sources of Russia’s wealth. http://tinyurl.com/3wyhbreh

U.S. Department of The Treasury. (2023, February 24). Fact sheet: Disrupting and degrading—One year of U.S. sanctions on Russia and its enablers [Press release]. http://tinyurl.com/mwpaxzsa

van Marle, G. (2020, December 11). ONE Apus stack collapse losses expected to top $200m. The Loadstar. http://tinyurl.com/5hxuhwtb

Wedemeier, J., & Wolf, L. (2022). Navigating rough waters: Global shipping and challenges for the north range ports. Intereconomics, 57(3), 192–198. https://doi.org/10.1007/s10272-022-1047-4

World Economic Forum. (2022). The global risks report 2022—17th edition. http://tinyurl.com/zar4fxru

World Meteorological Organization. (2023, July 4). World Meteorological Organization declares onset of El Niño conditions [Press release]. http://tinyurl.com/2djry89m

World Meteorological Organization & International Maritime Organization. (2019). Report of the WMO/IMO International Symposium Extreme maritime weather: Toward safety of life at sea and a sustainable blue economy. http://tinyurl.com/5j88r8fv

Wu, J., Zhan, X., Xu, H., & Ma, C. (2023). The economic impacts of COVID-19 and city lockdown: Early evidence from China. Structural Change and Economic Dynamics, 65, 151–165. https://doi.org.10.1016/j.strueco.2023.02.018

Yee, V., & Glanz, J. (2021, July 17). How one of the world’s biggest ships jammed the Suez Canal. The New York Times. http://tinyurl.com/4fpku5jj

____________

[1] Data is from the Yearbook of the Israel Ports Authority for 2022 and CBS data for that year.

[2] About the River Jordan terminal on the IAA website, see http://tinyurl.com/48876eyp

[3] NeoPanamax is the largest ship permitted to transit the Panama Canal (due to the limitation of the new raising and lowering system), measuring 370m in length, 51m in width, and 15.24m in hull-depth (which varies based on restrictions).

[4] TEU refers to the Twenty-Feet Equivalent Unit, which is a measurement of cargo capacity in units of 20-foot containers.

[5] About this phenomenon, see What are El Niño and La Niña? on the NOAA website.

[6] Transshipment refers to the unloading of a container from a ship in a port and then reloading it onto another ship to be taken to its final destination.

[7] Balancing refers to the process of returning empty containers to the port of origin when there is a surplus of exports.