Publications

INSS Insight No. 1574, March 20, 2022

The sanctions led by the US and the EU include asset freezing of designated Russian persons and entities. Analysis of reported Russian investments abroad (USD 382 billion in 2020) suggests that the vast majority of Russian investments are in sanctioning countries, and particularly in Europe. Hence, the effectiveness of the asset-freezing depends on the efficacy of the authorities and financial sector, particularly in Europe. However, there are indications of underreporting of Russian investments worth about USD 90 billion to Western authorities, which could undermine the sanctions’ effectiveness. At the same time, Russian investments in MENA are concentrated in Turkey, UAE, and Israel. They are of limited scope and importance for Russia or for the region, particularly after Russian investments in Turkey declined since 2017.

Freezing of assets of Russian institutions and persons is a major component of the US and EU- led sanctions on Russia announced following the invasion of Ukraine in late February 2022. This article examines the geographic distribution of Russian investments in other economies, which amounted to USD 381 billion at the end of 2020. It provides evidence that these sanctions can be highly effective, as two thirds of these investments are in the EU, which announced the largest number of sanctions since February 2022. At the same time, it provides evidence of underreporting of Russian investments to Western authorities, which could undermine the identification of Russian assets and thus efficacy of the sanctions. Russian investments in non-sanctioning countries – including MENA – accounted for only a fifth of the Russian investments abroad. The limited scope of Russian direct investments in MENA, with the exception of Turkey, shields the region from the direct impact of the assets freeze.

This article is based primarily on Russian data of direct investments abroad reported to the IMF, which provide coherent data on Russian investments in other economies. The Russian reports are also more detailed than the data on Russian investments abroad provided by other countries. However, there are gaps between data on Russian investments abroad provided by Russia and data provided by the investment-destination-countries. The article considers their implications for the sanction regime.

Russian Investments in Other Economies in 2020

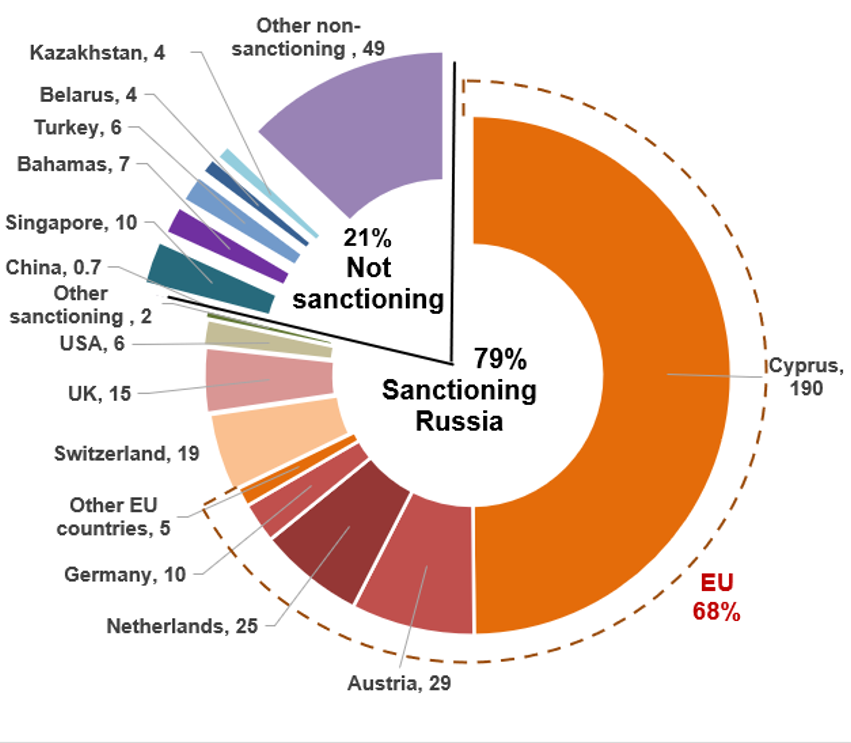

The distribution of reported Russian investments abroad at the end of 2020 suggests that these investments are likely to be highly vulnerable to asset-freezing-sanctions: 79 percent of these investments are in countries that announced sanctions on Russia, including the EU, US, UK, and Switzerland. Specifically, two thirds of Russian investments abroad are in the EU (USD 258 billion), and about half (USD 190 billion) are in Cyprus (figure 1).

Figure 1: Russian Investment Position Abroad, End of 2020 – USD billion

Source: Russian reports to the IMF

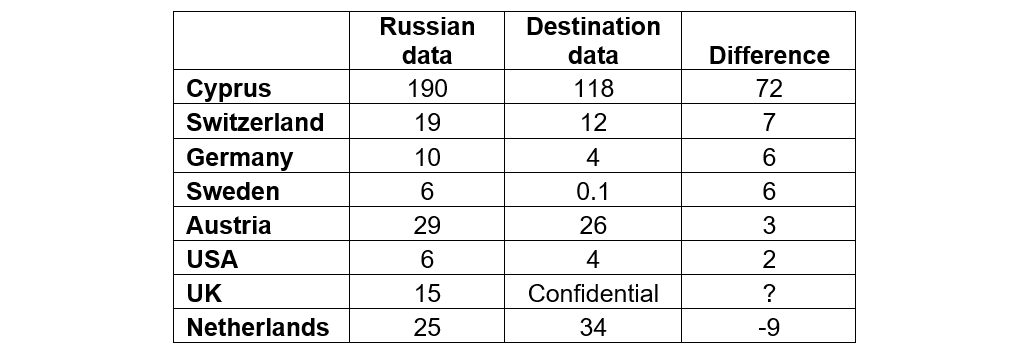

Interestingly, indications of underreporting of Russian investments to the authorities in some European countries arise from a comparison of Russian data with data by the destination economies. For instance, while Russia reported investing in Cyprus USD 190 billion, the Cypriot data suggest that Russian investments were merely USD 118 billion, resulting in a gap of USD 72 billion. Similarly, according to the Russian data, Russian investments in Austria, Switzerland, Germany, Sweden, and the US combined were USD 24 billion more than according to the Western authorities. The main exception is the Netherlands, whose estimate for Russian investment in its economy is larger than the Russian corresponding estimate (table 1). The apparent underreported investments in these countries amount to roughly USD 90 billion, or 23 percent of the Russian investments abroad.

Notably, this apparent underreporting to authorities of investment destinations and particularly in Europe could be used to disguise investments by Russian designated entities. There is no indication whether the apparent underreporting of Russian investments in various destinations is intentional. Yet it is troubling that the UK classified data on Russian investments in equity in the British economy as confidential in its report to the IMF. According to the Russian data, these investments in the UK amounted in 2020 to USD 15 billion, or about a half of the unspecified investments in the UK, including due to confidentiality. At any rate, the ability of the authorities and the financial sector in Europe to correctly identify Russian-owned assets is critical for the effectiveness of the sanctions.

Table 1: Russian Investments in Selected Economies according to Russian and Destination Reports

Source: Russian and destination reports to the IMF

Notably, only a fifth of the Russian investments abroad are in jurisdictions that did not announce sanctions against Russia (figure 1). The largest investments in non-sanctioning countries are in Singapore (USD 10 billion) and the Bahamas (USD 7 billion), which some scholars consider as offshore jurisdictions. Naturally, investments in offshore destinations might mask ownership of designated entities of assets in economies that observe the sanctions. Surprisingly, reported Russian investments in China are marginal (USD 0.7 billion).

Russian Investment in MENA

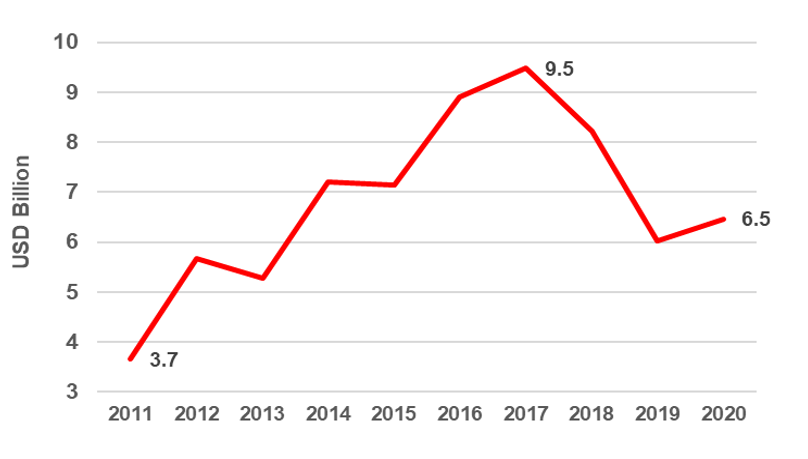

Russian investments in MENA countries are very limited and are concentrated in three countries: Turkey, UAE, and Israel. At the end of 2020, Russian investments in Turkey amounted to USD 6.5 billion or about 5.2 percent of total Foreign Direct Investment (FDI) in Turkey. Earlier, in 2017 Russian investments in Turkey peaked at USD 9.5 billion, or 21 percent of the current total FDI in Turkey. Evidently, the ongoing financial crisis in Turkey enhances the country’s need to bolster FX reserves including by enhancing FDI. Yet, the decline of Russian FDI in Turkey since 2017 reduces its vulnerability to the direct impact of the asset-freeze-sanctions.

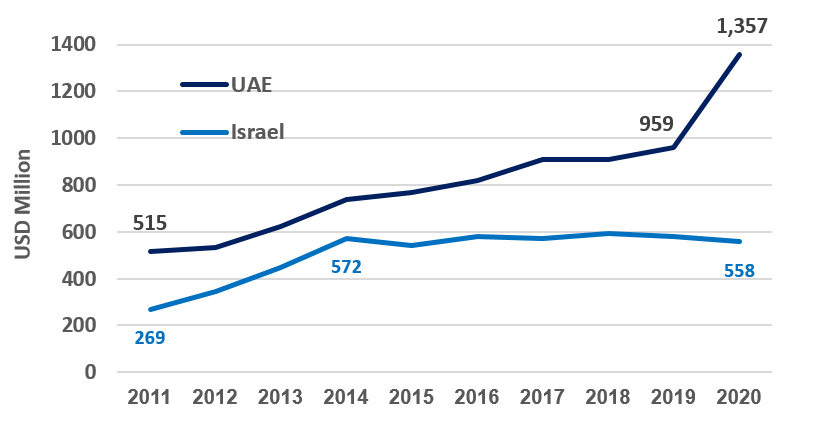

Russian reported investments in the UAE and Israel are even lower in value and their importance to these economies is limited. Russian investments in the UAE gradually increased over the last decade to about USD 960 million in 2019 and grew to USD 1.4 billion in 2020. On the other hand, Russian investments in Israel grew at the beginning of the last decade until the imposition of the 2014 sanctions on Russia, but stagnated ever since at around USD 570 million. At the end of 2020 Russian investments in Israel accounted to about 0.3 percent of the total FDI in the country.

Reported Russian investments in other MENA countries are marginal and amount to less than USD 100 million. Noticeably, there is no evidence for large Cypriot investments in MENA countries that could have disguised Russian investments.

Figure 2: Russian Investment Positions in Selected MENA Economies, 2011-20

- Turkey, USD billion

- Israel and UAE, USD million

Source: Russian reports to the IMF

____________

** The author thanks Gal Ginosar for assistance in data analysis, Tomer Fadlon and Katherine Bauer for helpful comments, and Hanadi Azzam for advice on data availability.